Encompass Insurance

See our Products

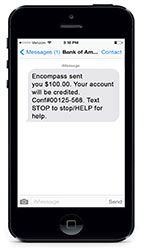

Encompass® Fast Mobile e-Payment

Choose the best fit for your claims payment

With Encompass, getting your claim payment is simple and quick. Through fast mobile e-payment, your auto and property claim payments can be issued on the same day.

How it works

- All you need is an email address or mobile phone number to use this payment option.

- An email alert will be sent upon your payment being processed. A first-time user will be required to register by supplying personal bank account information of where to direct the payment.

- A payment confirmation will be sent once the payment has safely been received.

Read the full Terms & Conditions

If you choose to request one of our electronic claim payment options, please read the following terms and conditions.

You may request any electronic payment option described above. If you request an electronic payment option as your preferred method of payment, there may be circumstances which still require a paper check to be issued. Participation is free and you will not be charged additional fees. You are not required to participate in electronic payment methods for your claim. You may choose to participate at any time by informing your claims service representative, should you have a claim. You may change your method of payment at any time by informing your claims service representative. If you change your method of electronic payment, we will update your change within your claim immediately upon notification. We will not impose any fee to change of payment option. If you choose to participate in electronic payment, you will be required to provide personal contact information such as an email address or cell phone number for texting. You may be asked to complete a registration process. It is your responsibility to provide us and the bank with true, accurate and complete e-mail address, contact, bank account, financial, and other information related to your electronic claim payment, and to maintain and update promptly any changes in this information. You can update your information (such as your e-mail address) by contacting your claims service representative during the handling of the claim.

Questions about Fast Mobile e-Payment?

- Your claims team member will be there to help you through every step of the claim process. Below are some answers to a few common questions.

Do I need a personal bank account with Bank of America, Chase, Wells Fargo or Capital One or another major US banks to use Fast Mobile e-Payment?

- No. As long as you have a personal account at a US based bank, you can receive payment through this option.

Can I use a pre-paid bankcard account with Fast Mobile e-Payment?

- No. You must use a checking account or savings account when registering and accepting payment.

How quickly will I receive my funds using Fast Mobile e-Payment?

- Encompass uses Bank of America to disburse claim payments.

- With a personal bank account through Bank of America, payment can be completed as soon as the same day.

- With a personal account through Chase, Wells Fargo or Capital One or another of the 80 major banks or 29 financial institutions that are members of Zelle, payment can be completed as soon as the next day.

- Should you have a personal account with any other bank other than those listed above, payment.

Is there a maximum dollar limit for a payment made by Fast Mobile e-Payment?

- The Fast Mobile e-Payment functionality itself does not have a limit. Claim settlement payments are based on the individual claim and policy terms, limits and conditions.

Can Fast Mobile e-Payments be used for recurring payments?

- Yes. There is no change to the process for setting up recurring payments.

I can’t locate the email or text message from Bank of America I used to register or accept my payment - What do I do?

- A reminder email will be sent out 4 days after the initial notification of payment if you have not ‘accepted’ the payment. All of the same detail including registration links are included in the reminder email.

I accidently rejected a payment, what are my options?

- The payment will be cancelled, and your claim service representative will follow up with you to resolve.

Have more questions?

Your claims team member will help guide you through every step of the claims process, and you can always reach out to your Encompass Independent Agent for more assistance or for further explanations of your policy coverage.

The coverages, features, and discounts on this website are not available in every state. Coverages, features and discounts subject to terms conditions, and qualifications. Policy exclusions may apply. Savings vary based on factors such as state and coverages selected. If you are a current customer, review your policy for coverage details. Otherwise, please contact an Encompass Insurance Independent Agent for availability and additional information.